Brookshire auto title loans offer quick cash using vehicle value as collateral, with interest rates and loan terms affecting costs. Shopping for rates, improving credit, and timely repayments manage costs effectively, ensuring borrowers keep their vehicles during repayment.

Understanding interest rates is crucial when considering a Brookshire auto title loan. This article, “Unlocking the Secrets of Brookshire Auto Title Loans,” demystifies these rates and their impact on your finances. We’ll explore how interest calculations work, delve into strategies to manage costs effectively, and offer insights to optimize your loan experience. By the end, folks navigating Brookshire auto title loans will be equipped with knowledge to make informed decisions.

- Unlocking the Secrets of Brookshire Auto Title Loans

- How Interest Rates Impact Your Loan

- Strategies to Manage and Optimize Loan Costs

Unlocking the Secrets of Brookshire Auto Title Loans

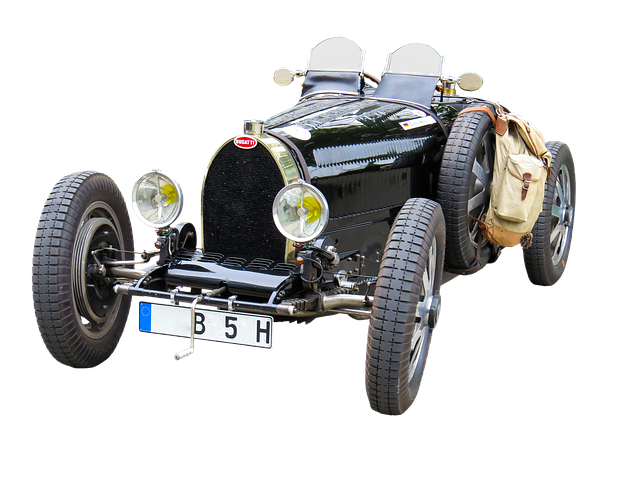

Brookshire auto title loans offer a unique financial solution for those seeking quick cash while keeping their vehicle as collateral. This innovative approach to lending provides an alternative to traditional loan options, catering to individuals with varying credit histories. By leveraging the value of your vehicle, these loans can be a game-changer when it comes to accessing emergency funds or funding unexpected expenses.

The process is straightforward and designed to be convenient for borrowers. It involves assessing the vehicle’s valuation, which plays a crucial role in determining the loan amount. Lenders will carefully evaluate your vehicle’s make, model, age, and overall condition to ensure its value aligns with the requested loan terms. This transparent approach ensures that you receive financial assistance when you need it most while keeping your vehicle as a valuable asset.

How Interest Rates Impact Your Loan

When considering a Brookshire auto title loan, understanding how interest rates work is crucial. Interest rates are essentially the cost of borrowing money, expressed as a percentage of your loan amount. The higher the interest rate, the more you’ll pay over the life of your loan. These rates can vary widely depending on several factors, including your credit history, the loan amount, and the lender’s policies. For instance, if you have excellent credit, you might secure a lower interest rate compared to someone with less-than-perfect credit.

The Loan Terms play a significant role in determining your overall interest expense. Longer loan terms generally result in lower monthly payments but lead to paying more in interest over time. On the other hand, shorter loan terms mean higher monthly installments but save you money in the long run. Car title loans in Brookshire often have distinct interest calculation methods, so borrowers should carefully review the terms and conditions before signing any agreements.

Strategies to Manage and Optimize Loan Costs

When considering a Brookshire auto title loan, managing your loan costs effectively is crucial to maximizing your vehicle equity. One key strategy is to shop around for the best rates; interest rates on these loans can vary significantly between lenders. Comparing offers from multiple institutions allows you to find the most competitive terms. Additionally, understanding and negotiating the fees associated with the loan is essential. Some lenders may charge processing or administrative fees, so be sure to inquire about these upfront to avoid surprises later.

Another approach to optimizing your Brookshire auto title loan costs is to improve your credit score before applying. A higher credit rating can lead to lower interest rates and better overall terms. This is because lenders perceive borrowers with strong credit as less risky. Furthermore, ensuring you have a clear understanding of the repayment terms and making timely payments will help avoid additional charges and penalties, ultimately saving you money in the long run, especially considering your vehicle ownership is at stake.

Brookshire auto title loans can be a convenient financial solution, but understanding interest rates is paramount. By grasping how these rates influence your loan and employing strategies to manage costs, you can make informed decisions that optimize your financial health. Whether it’s through timely payments or exploring refinements, managing your Brookshire auto title loan interest rates empowers you to navigate this option with confidence and avoid unnecessary expenses.