Brookshire auto title loans offer fast cash using vehicle titles as collateral, accessible to diverse borrowers despite credit scores. After providing proof and documents, approved borrowers receive funds quickly but must repay according to terms tied to the vehicle's title. Strategic repayment methods include extra payments, prioritizing principal, budgeting, and asset sales. Early repayment protects financial future, freeing up income for savings or emergencies. Evaluate financial standing, determine vehicle value, and build an emergency fund for a secure plan to pay off Brookshire auto title loans swiftly.

Looking to pay off your Brookshire auto title loan early? You’re not alone. Many borrowers seek strategies to accelerate repayment safely. This comprehensive guide provides a detailed overview of Brookshire auto title loans, along with effective methods to repay your loan faster. We’ll explore tips and tricks to protect your financial future, ensuring you make informed decisions. By following these steps, you can navigate the process securely and potentially save on interest.

- Understanding Brookshire Auto Title Loans: A Comprehensive Overview

- Strategies to Accelerate Loan Repayment: Safe and Effective Methods

- Protecting Your Financial Future: Early Loan Payoff Tips and Tricks

Understanding Brookshire Auto Title Loans: A Comprehensive Overview

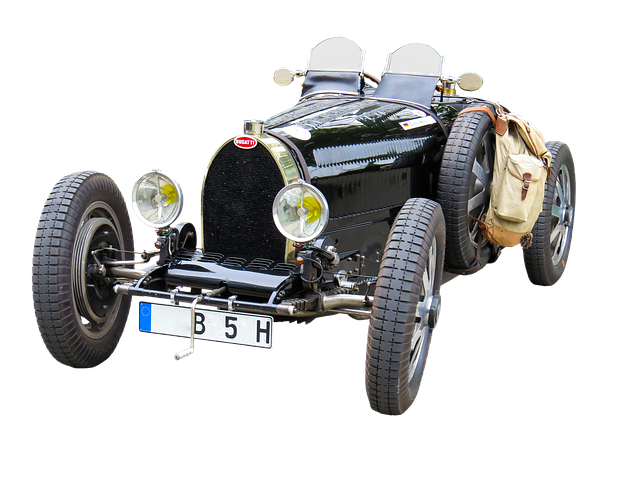

Brookshire Auto Title Loans, a specialized form of secured financing, offer individuals a way to access substantial funds using their vehicle’s title as collateral. This type of loan is designed for car owners who need quick cash and have a clear vehicle title in their name. Unlike traditional loans that rely heavily on credit scores, Brookshire Auto Title Loans assess the value of your vehicle, making them accessible to borrowers with various financial backgrounds. The process involves providing proof of ownership, verifying your identity, and submitting necessary documents. Once approved, you’ll receive funds, typically within a short timeframe, allowing for immediate access to capital.

These loans are particularly appealing in Fort Worth or similar metropolitan areas where quick approval is paramount. With the competitive market and high living costs, having a safety net of available cash can be invaluable. Secured loans like Brookshire Auto Title Loans provide borrowers with a clear repayment structure, as the loan is tied to your vehicle’s title. This ensures lenders have recourse if you default on payments, but it also means your vehicle could be at risk. Thus, understanding the terms and conditions, including interest rates and repayment periods, is crucial before taking out such a loan to ensure safe and early repayment.

Strategies to Accelerate Loan Repayment: Safe and Effective Methods

To pay off Brookshire auto title loans early and safely, consider implementing strategic methods designed to accelerate repayment. One effective approach is to make extra payments beyond the minimum required by your lender. Even small additional amounts can significantly reduce the overall loan balance and lower the total interest paid over time. Prioritize these extra payments towards the principal rather than interest to maximize savings.

Additionally, create a budget that allocates specific funds for loan repayment. This disciplined approach ensures consistent progress towards eliminating your Brookshire auto title loan debt. Leveraging additional income sources, such as side jobs or unexpected windfalls, can also accelerate repayment. For those with secured loans like car title loans or bad credit loans, consider selling non-essential assets to free up cash for early repayments. These safe and effective methods not only help you pay off your loan faster but also demonstrate responsible financial management.

Protecting Your Financial Future: Early Loan Payoff Tips and Tricks

Paying off your Brookshire auto title loan early can be a strategic move to protect and enhance your financial future. While it might seem appealing to rely on your vehicle as a source of funds, swiftly repaying the loan has several advantages. Firstly, it ensures you retain full ownership of your asset without any potential risks associated with long-term borrowing. This decision also opens up opportunities for better financial management. By eliminating the debt burden, you gain access to a larger portion of your income, enabling you to allocate funds for emergency situations or build valuable savings.

To achieve early repayment, consider evaluating your current financial standing. Conducting a thorough vehicle inspection can help determine its current market value, which is essential for negotiating better terms with lenders. Additionally, building an emergency fund can provide a safety net and reduce the need for future loans. With a clear understanding of your finances, you can create a realistic plan to pay off your Brookshire auto title loan swiftly and securely.

Paying off your Brookshire auto title loan early not only saves you on interest but also demonstrates responsible financial management. By implementing the strategies outlined in this article, such as creating a budget, exploring additional income streams, and avoiding unnecessary expenses, you can safely accelerate repayment and gain control of your financial future. Remember, early payoff is a testament to your discipline and commitment to debt-free living.